With the power to decide how to allocate budget, the CFO plays a difficult and important role in cybersecurity investment decisions. As mentioned by Hugh Taylor in a recent article for The Journal of Cyber Policy, the challenge is “getting CFOs and boards to understand the financial impact of cyber threats.” Axio’s CEO, Scott Kannry, shared insights into how to alleviate this conundrum.

The answer lies in cyber risk quantification, which can size impact in financial terms and subsequently inform the most appropriate budget decisions. Scott says,

“You have to take a deep look at the real costs of dealing with a major cyber incident, way past any pro-forma ‘duty of care’ standards you may have used in the past. What will it actually cost to deal with a catastrophic event?”

He later expands on his point and discusses how

“You also have to be completely aware of how your cyber insurance and general liability policies will actually work if you are going to rely on it to cover your costs on your worst imaginable day…You might be surprised at how many cyber exclusions your property policy actually contains.”

Can’t Ignore the Low-Frequency but High-Impact Cyber Events

Axio is a firm believer in transparent cyber risk quantification because it arms cyber leaders with the language necessary to clearly communicate the financial impact of cyber events. It’s especially important to understand and translate the impact of low-frequency, high-impact events. As mentioned in our previous blog, being too focused on probability and annual loss expectancy (ALE) can be detrimental to organizations. ALE works for cyber events that have predictability based on historical patterns. But organization leaders must also take into consideration low-frequency, high-impact events. Without preparation, organizations may struggle to recover if these events are realized. They are the “catastrophic” events that Kannry mentioned above that can lead to “your worst imaginable day.” One way leaders prepare for these events is by purchasing insurance policies. However, they need to be aware of the cyber exclusions within their policies and truly understand where they are covered.

Looking at Cyber Risk Quantification Hand in Hand with Insurance

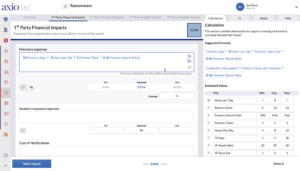

With so many considerations and the growing complexity of cyber-attacks, Axio360 enables you to quantify your cyber impact with clarity and to truly understand your cyber insurance policies. With our platform, you get complete visibility and control over how your impact is quantified. Our quantification module contains a formula builder to help you do just that.

Axio360 allows you to map out the first-party financial and tangible impacts and the third-party financial and tangible impacts. Axio360 also allows you to visualize these scenarios side by side with your insurance to see where the gaps are. For example, you may have $10M net impact in first-party financial impacts and have $54M in insurance. But on the other hand, you have $20M net impact in third-party financial impacts but only $2M in insurance. With that information, you can decide whether or not purchasing more insurance is necessary. Cyber risk quantification allows you to identify your company’s biggest vulnerabilities. It also makes it easier for CFOs and boards to see why it’s necessary to allocate budget to mitigating potential cyber events.

Moreover, Axio360’s insurance module allows users to upload their policies and our platform flags exclusions and clauses within that policy. This makes it easier for organizations to see if they are actually covered when it comes to certain cyber events. With this ability and our quantification capabilities you can stress test your insurance portfolio.

Make the Case for Your Cyber Budget

Let Axio help you identify the risks that require immediate attention. Gain insight into how to effectively allocate your resources. By preparing for these low-frequency but high-impact events, it gives organizations a fighting chance when cyber adversaries target them. With cyber threats more prevalent than ever, we want to help organizations prepare for their future. To learn more about Axio360’s unique methodology, take a look at our free ebook.