Why Axio CRQ is the Right Solution for Your Organization

Launch in Under 30 Minutes

Say goodbye to lengthy setups. With our Financial Services CRQ Catalog, you can be up and running in less than 30 minutes, empowering your team to start driving results immediately.

Build Scenarios Your Way

Customization is at the core of Axio CRQ. Whether you’re creating complex or ad-hoc scenarios, our Advanced Mode UI lets you craft them exactly how you envision, with ease and precision.

Transparent, Industry-Leading Methodology

Trust in a methodology that’s recognized as one of the best in the industry. Axio CRQ is the most transparent solution available, giving you full confidence in the accuracy and integrity of your results.

Built on Deep Industry Expertise

Backed by Axio’s deep knowledge and partnerships within the financial services sector, our platform offers unparalleled insights, so you can rely on our numbers and expertise every step of the way.

Complex financial organizations increase their cybersecurity posture with Axio

We needed efficiency to do our job correctly and for Riverstone to grow and be protected from new and unforeseen cyber risks. Axio helped our companies improve in specific cybersecurity areas to protect capital for our investors. The results were evident quickly.

Eliot Cotton, Principal and Assistant General Counsel of RiverstoneAccess Once, Report Many Times

As a financial services institution, you must meet prescribed regulatory requirements. With Axio360 you can map your assessments to get started quicker.

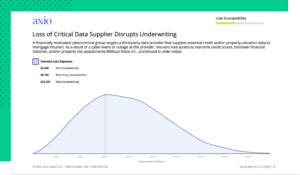

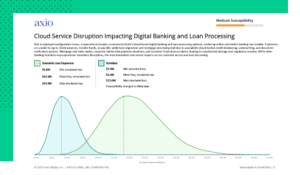

Assess Your RiskPre-Built or Fully Custom Scenarios—You Decide

Axio offers a robust catalog of scenarios tailored for financial services organizations, so you can begin your Cyber Risk Quantification (CRQ) journey in under 30 minutes. Prefer something more specific? Customization is at the heart of Axio CRQ. Our Advanced Mode UI empowers you to design complex or ad-hoc scenarios with the precision and flexibility your business demands.

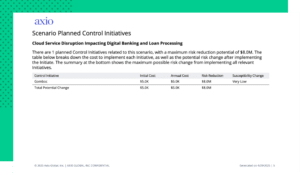

Quantify Your RiskAlign Security Initiatives with Business Objectives

Get the budget you need. Communicate cyber security priorities in business terms.

Manage & Plan