Your blueprint for sustainable cyber insurance

Traditional risk models don’t apply to cybersecurity. Attacks are increasingly sophisticated, ransoms are rising, and uncertainty is growing. With such a fast-moving threat vector, historical loss data has a finite shelf-life of relevance and makes accurate decisions challenging for all parties in the cyber insurance ecosystem.

Axio provides the tools to realize the potential of this dynamic and growing marketplace. With Axio, carriers, brokers, and customers seeking cyber insurance get a shared view of a company’s security posture, so they can agree on appropriate insurance limits, the broadest coverage, and the fairest rates.

Insurance is in our DNA

Axio’s experts come from the ranks of top insurance providers and are steeped in the underwriting language and complex relationships of the insurance industry. By applying the MITRE attack framework and quantifying the impact of a successful cyber incident, we help you get an accurate picture of the loss exposure to aid in prioritizing strategies to transfer risk.

FOR ENTERPRISES

Right-size insurance coverage and decreased premiums

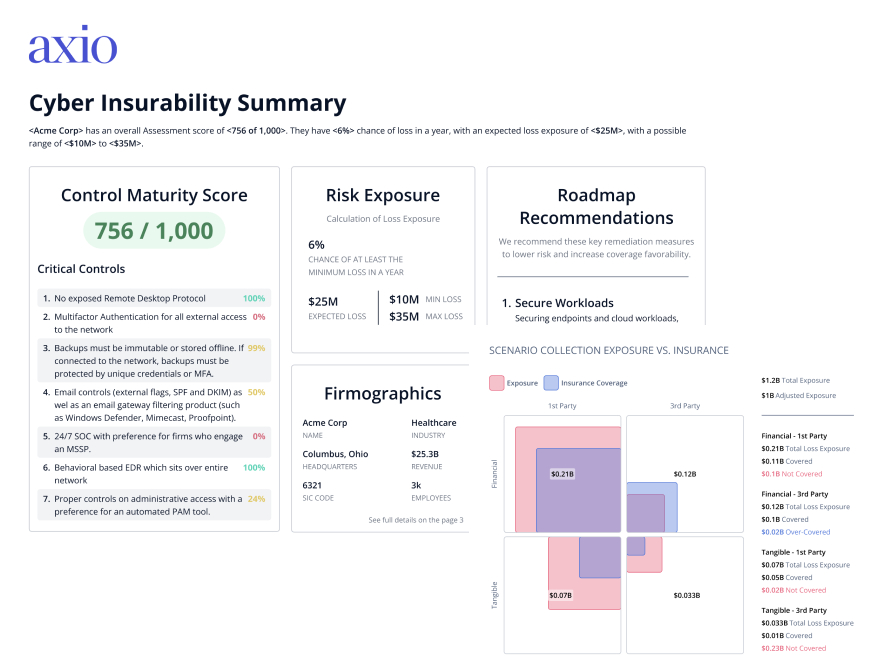

Spending too much on insurance takes capital away from other business priorities. Having too little means you couldn’t recover from an attack on your most critical assets. The goal is to satisfy your needs while avoiding the pitfalls. Axio helps you determine how much cyber insurance you need, based on loss scenarios.

- Calculate impact of successful cyber attacks

- Compare to your insurance policies

- Understand any gaps in your coverage

- See where you may be over-insured

- Submit results to your broker or carrier

FOR BROKERS

Remove friction from the cyber insurance process

Spend less time evaluating cyber insurance options and preparing for renewals with a streamlined assessment and quantification process. You become a trusted advisor to both enterprises and carriers, with high customer satisfaction and retention rates to match.

FOR INSURANCE PROVIDERS

Properly quantify risk exposure for better underwriting outcomes

The variables that impact cyber risk are often hidden and always changing. Instead of combing through the weeds of static cyber risk engineering reports, you’ll be able to easily identify areas of highest risk across customer organizations. Axio helps you make accurate judgments on a continuous basis so you can provide coverage terms and limits that are appropriate and competitive.

See the big picture of all risk scenarios and dive deep into each one