Connect your cybersecurity policies and investments to strategic priorities

When you’re aligning cybersecurity and business strategy you must consider many aspects. One tool won’t give you all the information you need. With Axio you can use the whole toolbox.

![]()

An easy-to-use platform for dynamic,

collaborative decision-making

Axio360 links control-based risk assessments to real-life risk scenarios. This rounded approach consolidates data from multiple sources and enables people with different perspectives to build consensus.

Align to industry and compliance frameworks, with controls that can be observed and measured. Benchmark your posture against industry best practices and other companies like you.

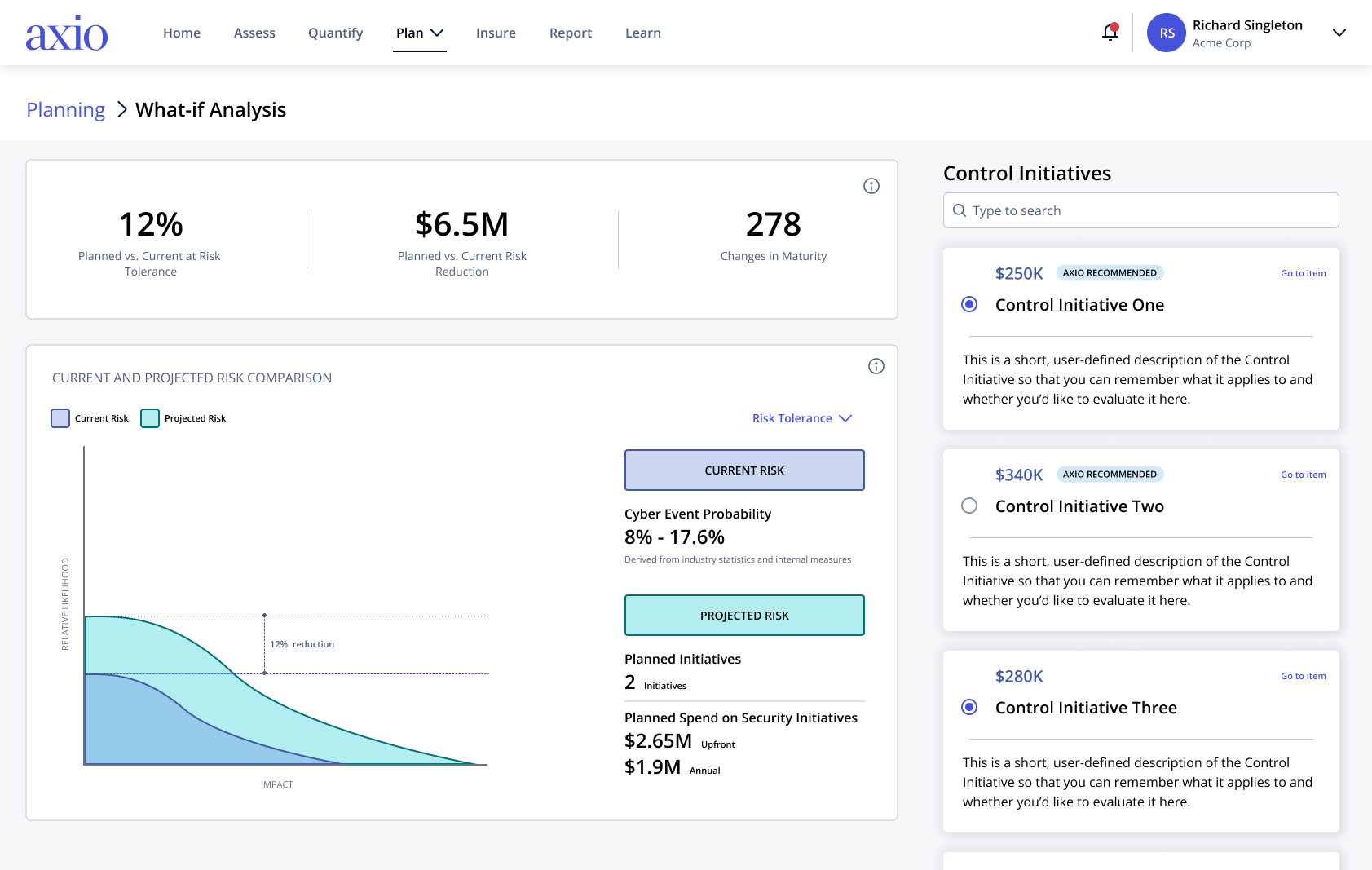

Calculate the financial and tangible impact of a successful cyber attack on your business and on third parties. See how adjusting your security controls will impact multiple risk scenarios. Prioritize investments that balance risk and budget.

Ensure insurance coverage matches your company’s risk exposure and risk tolerance. Optimize insurance premiums and coverages based on demonstrated risk management.

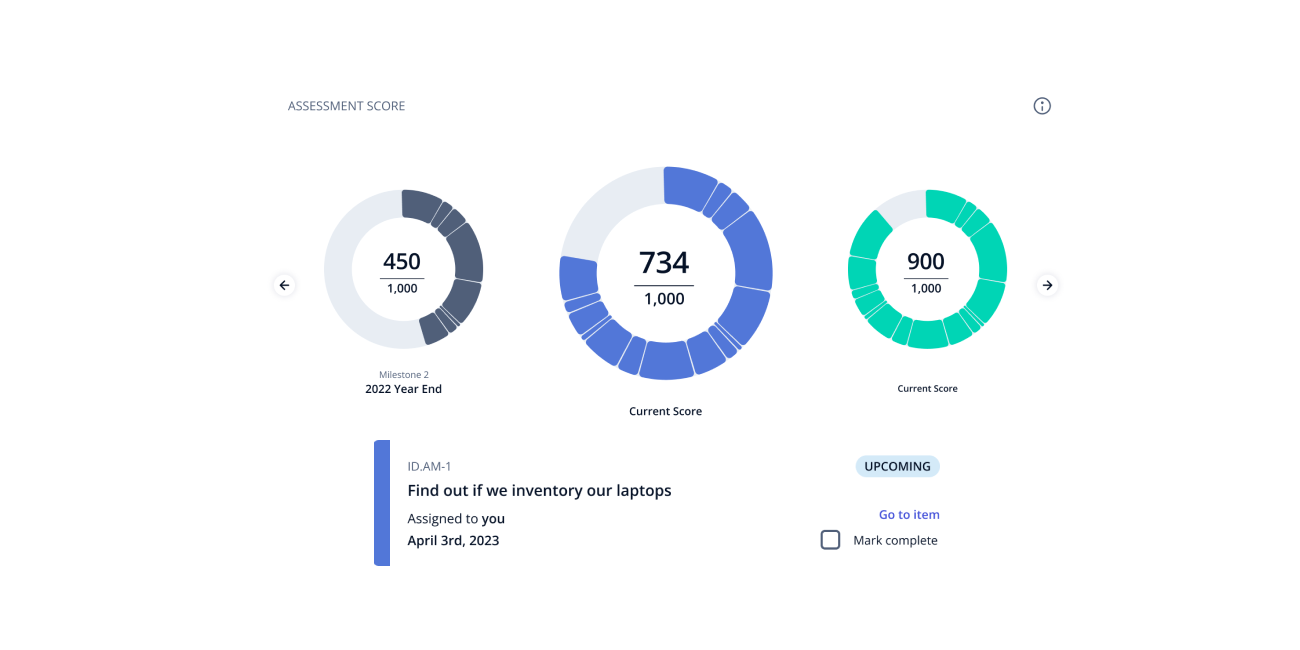

Set targets and timelines to reach them. Assign tasks to team members directly in their workflow systems. Track progress and compare results over time.

A flexible framework, customized for you

The Axio methodology is built with standard but flexible principles that you can adjust to your needs. Putting this kind of system in place helps ensure that risks presenting the greatest potential impact to your organization are addressed first, while also increasing understanding of risks and tradeoffs throughout the organization.

Start fast and grow smart

Axio is easy to use. You can get going right away with pre-populated frameworks, scenarios, and formulas. Because you begin your analysis with 99% fidelity, all you and your team must do is review and adjust, add evidence, and plan. A programmatic, continuous approach becomes part of your regular business planning.

Whatever your stack, we’ve got your back

If you’ve already been using a framework, model, or risk register, Axio can leverage your hard work and build from there. We integrate with a variety of IT and workflow systems, so Cyber Risk Economics becomes an embedded part of your business process.